London holiday slows the market activity

This week is a London bank holiday. Next Monday is a US bank holiday. Just a little more summer to deal with traders. Today there is some "minor" US data released with the Chicago PMI, Milwaukee and Dallas Fed manufacturing indices. Chicago will probably be the most important (at 9:45 AM, estimate 54.5 vs 54.7 last). The index has a 12 month high of 64.5 (Oct 2014) and low of 45.8 (in Feb 2015). In Europe the CPI data did not falter even though energy prices were down 7.1%. Weekend Jackson Hole comments seem to suggest the plan to raise rates remains intact for 2015. Will they raise it in September still remains the big question.

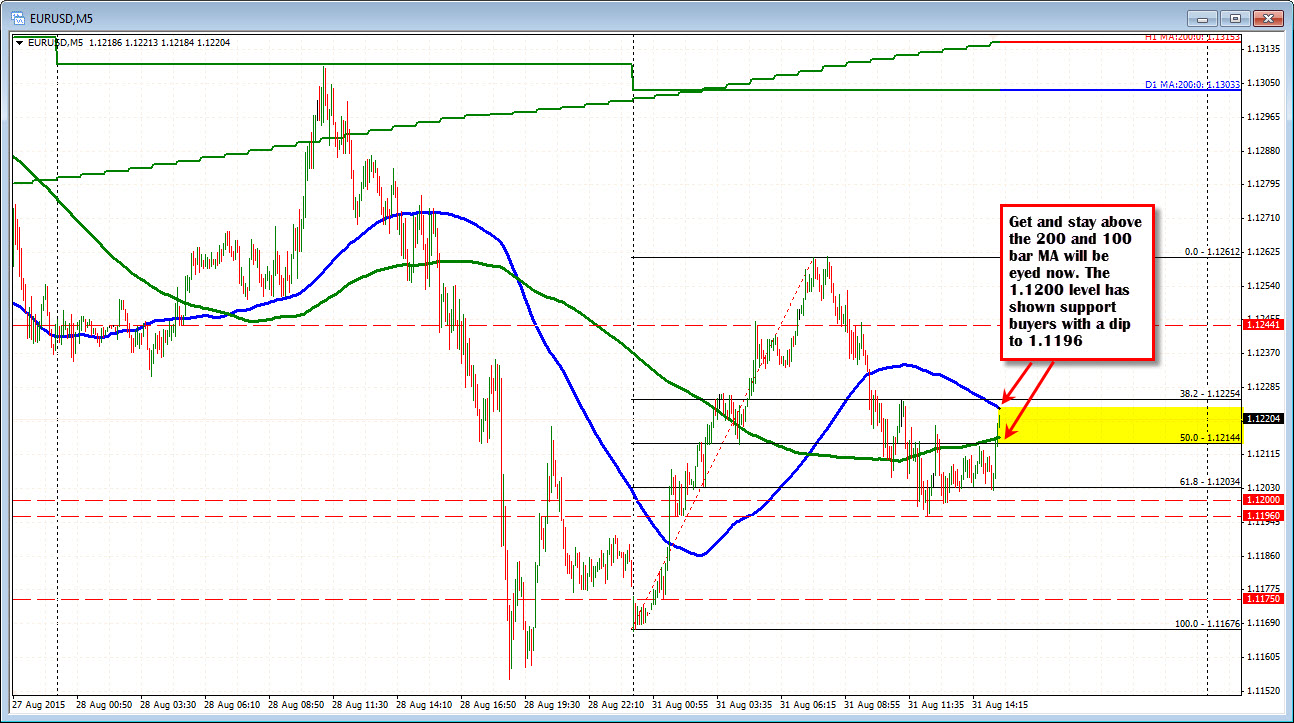

The EURUSD is higher on the day but trading back down near the midpoint of the days range. The market could not sustain a rally after the inflation data did not disappoint (it was not great but did not surprise to the downside). The market price has been trading mostly above the 1.1200 level (the low price dipped to 1.1196). Looking at the 5 minute chart, getting above the 1.1214-16 level (50% of the days range and 200 bar MA), followed by a break of the 100 bar MA 1.12230 would be eyed for more bullish intraday bias (need to stay above).

A failure to do so, would have traders thinking of another shot at the 1.12000 level. Getting and staying below the 1.1200 level will look toward the 1.1175 where a trend line on the hourly chart (from August 7th low) cuts across. The low in the first hour of trading today came in at 1.1167, the low on Friday was at 1.1155. All become targets in trading today.

So far, the 100 and 200 area are holding on the 5 minute chart, but activity is still slow.

No comments:

Post a Comment