WTI crude up more than 6% in third day of gains

There are two popular theories as to why crude oil prices turned around today. Here's why they don't add up.

1) Falling US oil production

The EIA released a new report today and it showed US production at 9.3 million barrels per day in June compared to 9.4 mpbd

2) This is the headline that people are pointing too:

Here is the full quote from the OPEC publication, which is really a magazine, not some kind of statement from the cartel.

"As the Organization has stressed on numerous occasions, it stands ready to talk to all other producers."

Continuing: "There is no quick fix, but if there is a willingness to face the oil industry's challenges together, then the prospects for the future have to be a lot better than what everyone involved in the industry has been experiencing over the past nine months or so. Only time will tell."

The best reasons for oil gains

They're the same three reason oil has gained for the previous two days

- China cut rates

- Sentiment rebounded

- Massive short squeeze

Italy HICP y/y

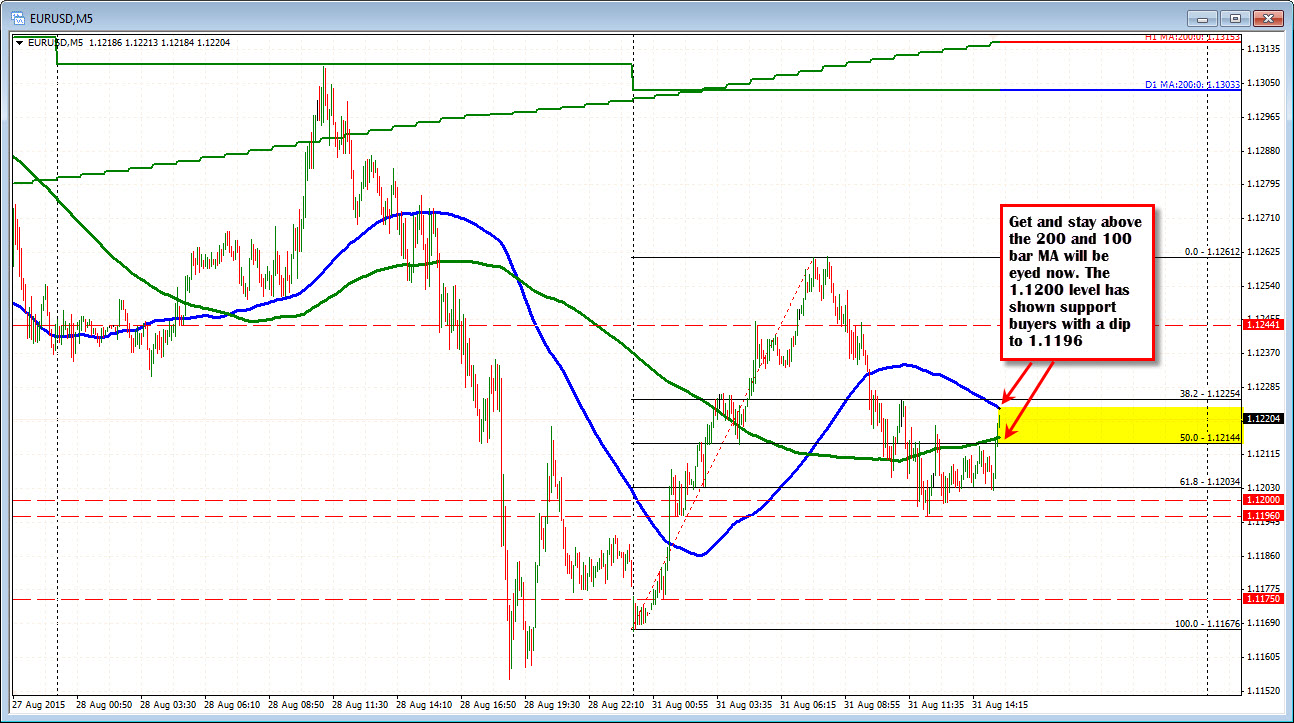

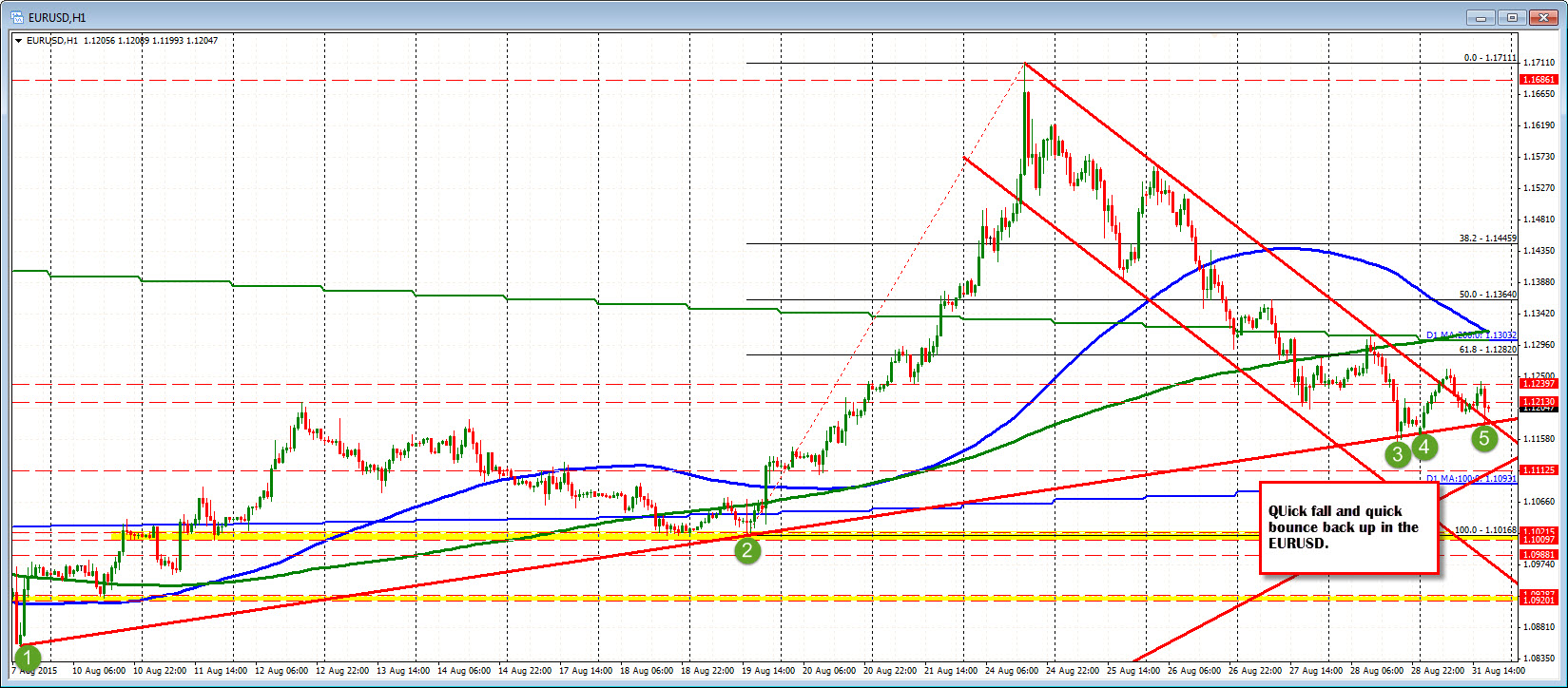

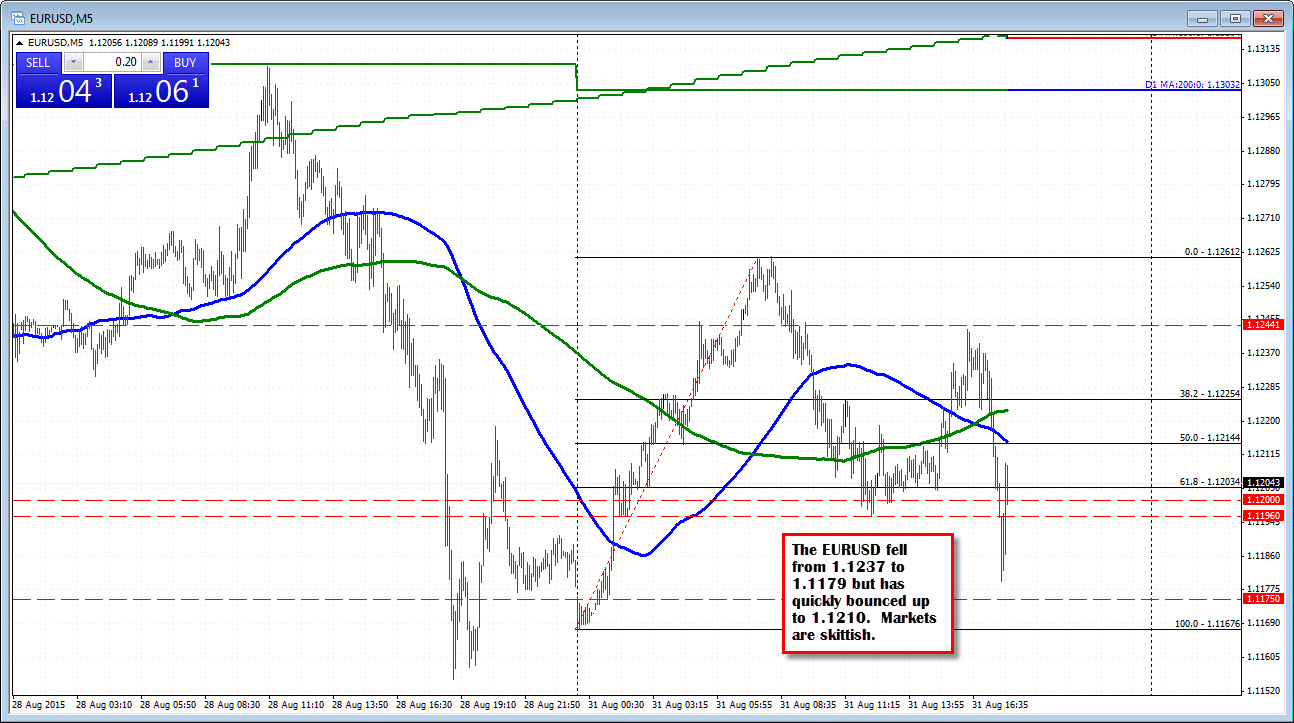

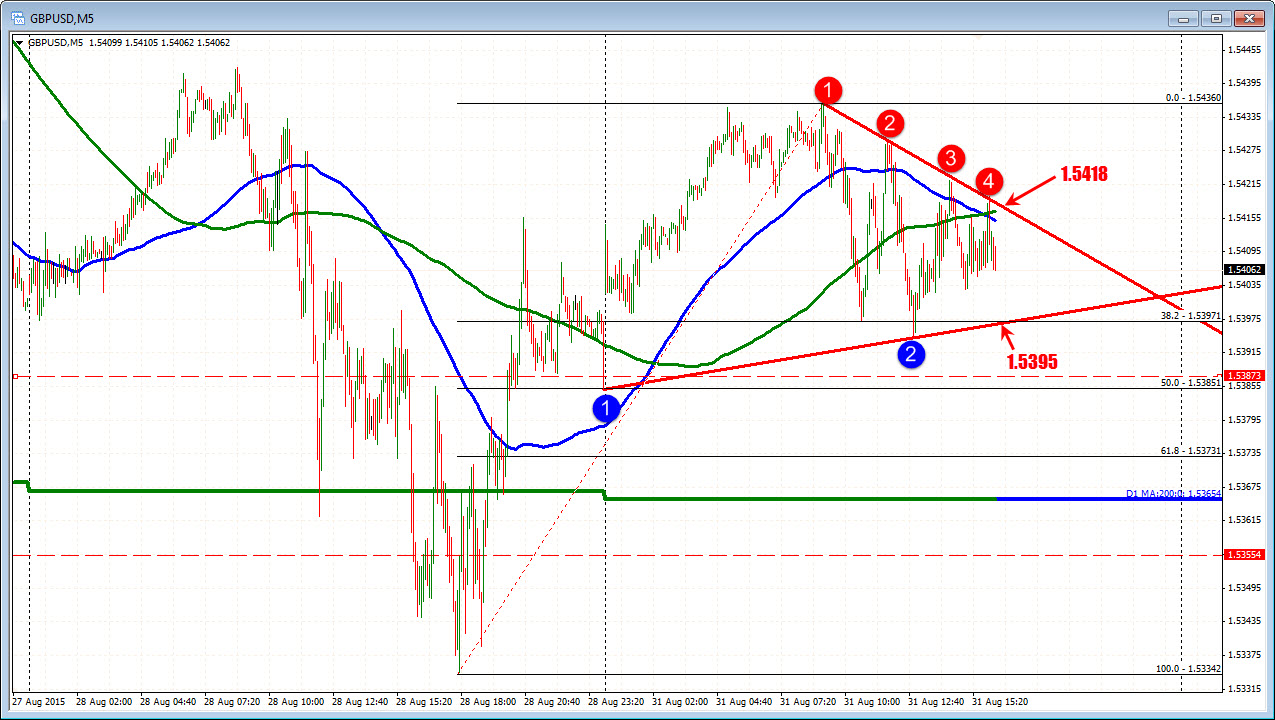

Italy HICP y/y EURUSD 15m chart

EURUSD 15m chart